A sales tax is a tax added to the sale price of an item. Businesses selling tangible items within the normal course of business in North Carolina typically must charge sales tax to their customers and remit the collected tax to the appropriate state agency. Tangible means the item must be “perceptible to the senses”: seen, smelled, weighed or measured, or touched. North Carolina does not require most service-based businesses to collect or pay sales tax. However, manufacturing services, some construction trade related services, and select other services may carry sales tax obligations.

Originating in 1939, use tax applies when a retailer does not charge sales tax on taxable items or applicable services purchased. Retailers typically collect tax at the time and point of sale. However, if you purchase an item which is not for resale and you did not pay sales tax, you must pay a use tax regardless of where the item was purchased. The use tax is reported on the same form as sales tax for your business, described below.

-

- Enter your business contact and sales tax ID number, then choose “File E-500 and pay the full amount online”.

-

- From the drop-down menu, select the month, date, and year. Sales tax is usually filed either monthly or quarterly, initially determined based on how you completed the NC-BR form when you applied for your sales tax ID number.

-

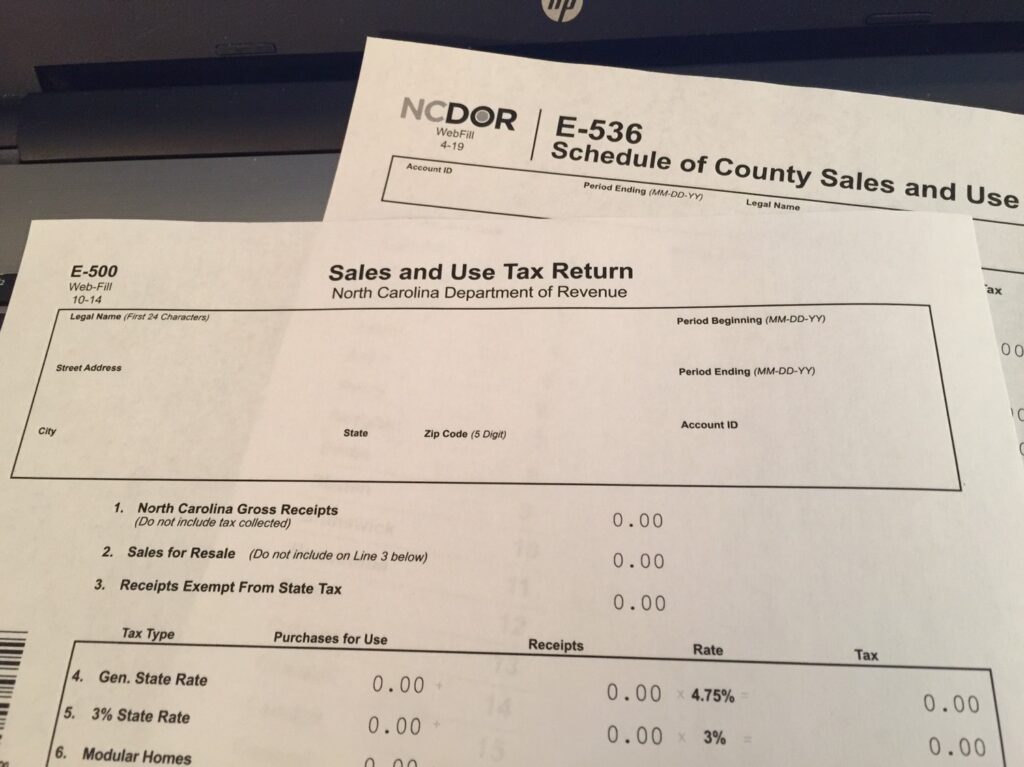

- Enter your gross receipts for the reporting period in the NC Gross Receipts box 1. Enter any sales for resale in box 2. Enter any sales that are exempt from sales tax (i.e. services sales or sales to a government agency) in box 3.

-

- Calculate the difference of gross receipts less sales for resale less receipts exempt from sales tax. That amount is entered in the Receipts column, General State Rate, box 4. The form will automatically calculate the tax due in the right-hand tax column. Note: Box 6, 7 and 8 are for specific types of sales and don’t apply to all businesses.

-

- Enter the same amount calculated above in the appropriate County Rate (box 9 or 10)

-

- Enter the same amount in Additional County Rate box 11 if you are in Durham, Mecklenburg, Orange or Wake County.

-

- If you have purchases that you did not pay sales tax on and were not for resale, then complete the same boxes under the Purchases for Use column (use tax) for the amount of the purchases. The form will fill in your total amount of tax at the bottom – this is the amount you pay.

-

- If you are filing online, the next page will require that you list the county tax collected by county. If you are reporting for multiple counties, enter an amount for each county. This should match the total of what you entered in box 9, 10, and 11. If you are manually filing, complete form E-536 instead.

-

- The form will fill in your total amount of tax at the bottom – this is the amount you pay.

-

- If you are filing online, the next page will require that you list the county tax collected by county. If you are reporting for multiple counties, enter an amount for each county. This should match the total of what you entered in box 9, 10, and 11. If you are manually filing, complete form E-536 instead.